ohio unemployment income tax refund

Taxpayers who previously filed federal and Ohio tax returns without the unemployment benefits deduction but who are not entitled to any additional Ohio refund. Report it by calling toll-free.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

You can also call the departments individual taxpayer.

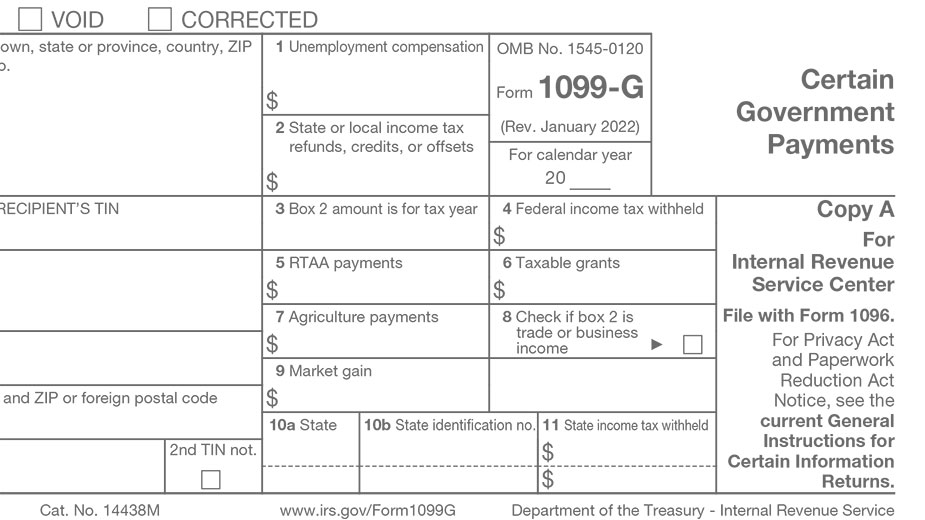

. To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. Report unemployment income to the IRS. The amount of tax will depend on your tax bracket.

Used by employers to authorize someone. More than 16 million taxpayers are set to receive refunds or credits totaling 12 billion. After the IRS makes the adjustment the.

The agency is juggling the tax return backlog delayed stimulus checks and child tax credit. Taxpayers whove already paid a fine will automatically be given refunds the IRS said. File unemployment tax return.

JFS-20106 Employers Representative Authorization for Taxes. The IRS says not to call the agency because it has limited live assistance. Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest.

COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received. Some states will mail out the 1099G. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

Your Ohio adjusted gross income Ohio IT 1040 line 3 is less than or equal to 0. See How Long It Could Take Your 2021 State Tax Refund. Unemployment compensation is taxable on your federal return.

Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate. Food Stamp Non Discrimination Statement. If unemployment benefits are included in federal adjusted gross income AGI they are taxed under Ohio law.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. You may apply for a waiver of these assessments. The Ohio Department of Taxation provides a tool that allows you to check the status of your income tax refund online.

True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits. If you are subject to Ohios income tax you must file an Ohio IT 1040 even if you are due a refund unless. Is There a Tax.

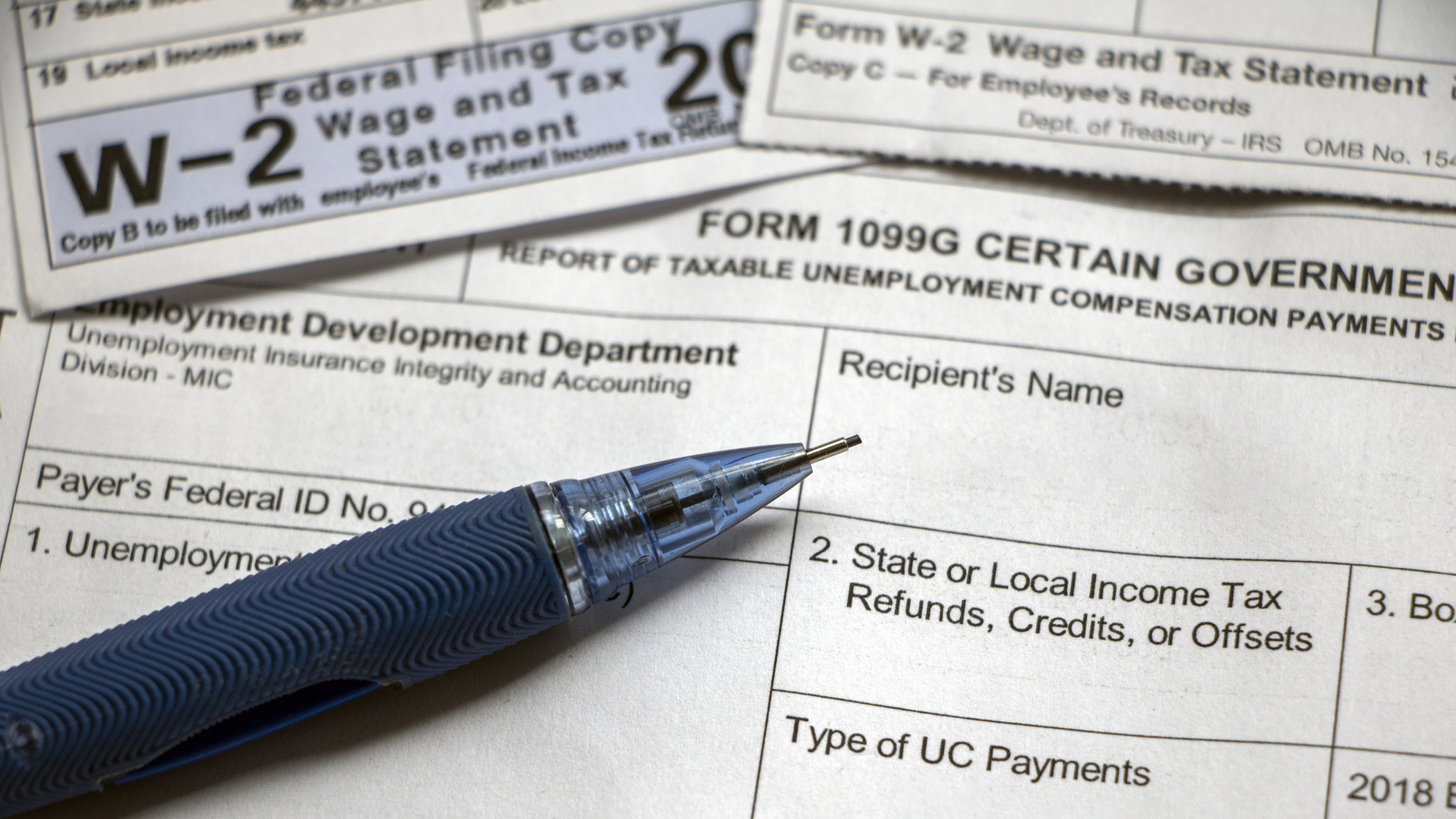

Should you have any questions please call. You will have to enter a 1099G that is issued by your state.

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Some People Not Receiving Unemployment 1099 G Tax Forms

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Time Running Out For Ohioans Claiming 2017 Tax Refund

How To Claim Unemployment Benefits H R Block

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Ohioans Can Now Apply To Keep Overpayment Of Unemployment Benefits

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Will My Unemployment Benefits Affect My Tax Refund Gudorf Tax

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Ohioans Who Paid Income Tax On Last Year S Unemployment Benefits May Get Refunds Cleveland Com